Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are people saying about annuities?

- What about supplemental income strategies for retirement?

- Should alternative income strategies be used in retirement?

- What about rental income?

- What about rental income in a pandemic?

- Is your rental property your annuity?

- How is this working out?

- What about Moody’s analytics?

- How many renters are behind on rent?

- What about mom and pop landlords?

- What are squatter’s rights?

- What about contract law?

- What about laddered bonds?

- What about taxes?

- Have you heard Episode 138?

- What about MUNI bonds?

- What did Barron’s say?

- What did Mark see at the Oriental Museum?

- What about liquidity?

- What is a Single Premium Immediate Annuity (a SPIA)?

- What about inflation?

- What about the Mack Truck factor?

- What have the insurers done with the annuity gotchas?

- What is the fixed indexed annuity?

- Have you heard Episode 80?

- What about income?

- What about a steady stream of income in retirement?

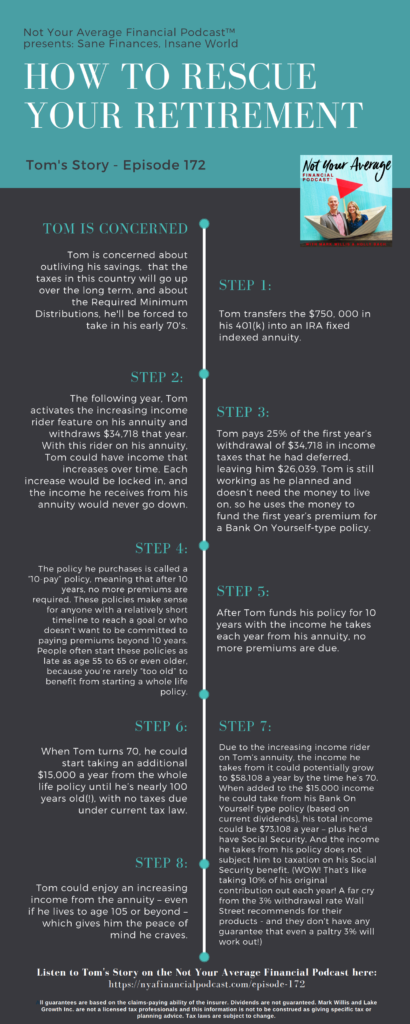

- How does one fund an annuity?

- What are the choices?

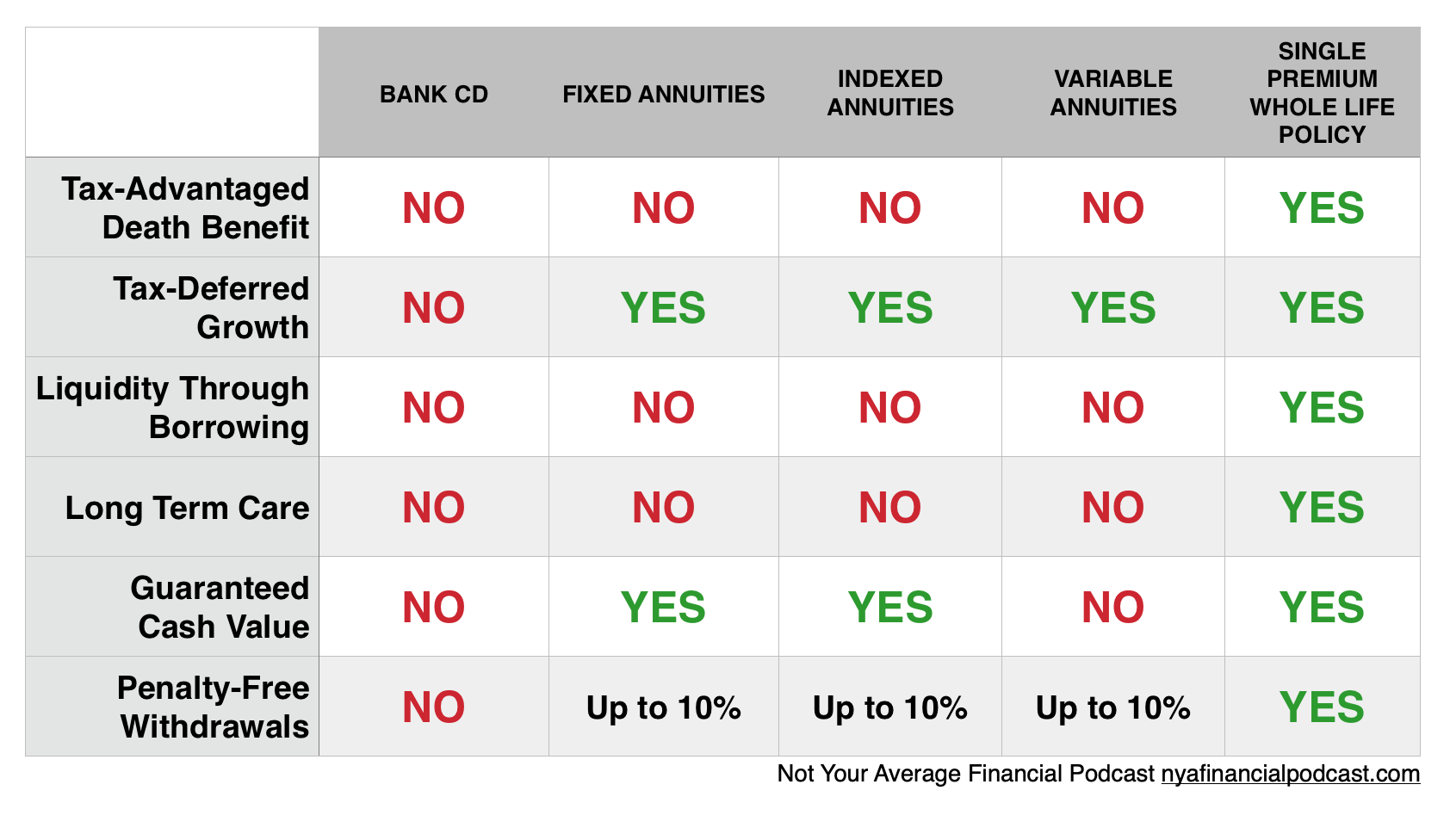

- What are the tradeoffs?

- What are the protections?

- What about qualified and non qualified plans?

- How does a fixed annuity address the liquidity problem?

- Who has the cash?

- What is an idea for liquidity?

- What about the inflation problem?

- Can you lose money due to market fluctuations?

- What about the participation rate?

- What about an inflation protection hedge?

- What about competitive market returns without loss?

- What about increasing income in retirement?

- What about a pay raise in retirement?

- What about a guaranteed minimum income for life?

- What about the insurers addressing the Mack Truck factor?

- What about gifting the unspent lump sum to your beneficiaries?

- What about nursing home care?

- What about double income payments in a qualified care facility?

- Do you have a bond that can do that?

- Do you have a rental property that can do that?

- What are the benefits of the indexed annuity?

- What are the downsides?

- What are the risks?

- Who is an indexed annuity good for?

- What about medium and long term savings goals?

- What about short term goals?

- What do you want your money to do for you?

- Who are indexed annuities NOT good for?

- What about surrender charges?

- What about liquidity?

- Would you like to meet with Mark?

- What about looking at your Social Security benefits online?

- Do you have a plan for long term care?

- Do you have a plan for your home equity?

- How might your home equity support you in retirement?

- Do you still need to buy stuff?

- Would you like to join the Not Your Average Financial Community?

Anita Bennett, a Vancouver born and Vancouver Island raised SFU Business Graduate who started her career specializing in Marketing, has been working with families since 2010. Her first business, a play-café called Kinder Café, was located in Port Coquitlam, BC, and was dedicated to providing a safe place for the community to connect with their children.

Anita Bennett, a Vancouver born and Vancouver Island raised SFU Business Graduate who started her career specializing in Marketing, has been working with families since 2010. Her first business, a play-café called Kinder Café, was located in Port Coquitlam, BC, and was dedicated to providing a safe place for the community to connect with their children.

Nicole Martin is Chief Empowerment Officer and Founder of HRBoost, LLC, a HR Shared Services consulting firm based in Chicago, Illinois. In recognition of her professional excellence as well as her community, Nicole has been honored by multiple organizations including most recently as one of Mirror Review’s 10 Game Changing Women in 2019. Awardee for Business Excellence by the Chicago Daily Herald, and a 2016 Enterprising Women of the Year Champion by Enterprising Women Magazine. A sought-after expert, her knowledge and advice have been featured in newspapers and magazines throughout the country. In addition, Nicole is the host online of HR in the Fast Lane and contributing writer for the Chicago Business Journal. Nicole has authored, International Literary Award and Amazon Best Seller, The Talent Emergency, the accompanying Talent Emergency Guidebook, The Human Side of Profitability, The Power of Joy & Purpose, and her newly released co-authored

Nicole Martin is Chief Empowerment Officer and Founder of HRBoost, LLC, a HR Shared Services consulting firm based in Chicago, Illinois. In recognition of her professional excellence as well as her community, Nicole has been honored by multiple organizations including most recently as one of Mirror Review’s 10 Game Changing Women in 2019. Awardee for Business Excellence by the Chicago Daily Herald, and a 2016 Enterprising Women of the Year Champion by Enterprising Women Magazine. A sought-after expert, her knowledge and advice have been featured in newspapers and magazines throughout the country. In addition, Nicole is the host online of HR in the Fast Lane and contributing writer for the Chicago Business Journal. Nicole has authored, International Literary Award and Amazon Best Seller, The Talent Emergency, the accompanying Talent Emergency Guidebook, The Human Side of Profitability, The Power of Joy & Purpose, and her newly released co-authored

Joel Noble is Director of Public Policy at Samaritan Ministries International, where he has served since 2001. He directs the ministry’s legislative program, advocating with federal and state governmental bodies. He also consults for the Alliance of Health Care Sharing Ministries. Joel earned his bachelor’s degree in history education from Illinois State University, with an emphasis on political science, geography and sociology. He completed a Master of Arts in leadership studies from the Seminary at Lincoln Christian University, where his final research paper focused on what the Bible teaches on the proper jurisdiction of the family, church and civil government. He has been married to his wife, Sarah, for 19 years. They have four boys.

Joel Noble is Director of Public Policy at Samaritan Ministries International, where he has served since 2001. He directs the ministry’s legislative program, advocating with federal and state governmental bodies. He also consults for the Alliance of Health Care Sharing Ministries. Joel earned his bachelor’s degree in history education from Illinois State University, with an emphasis on political science, geography and sociology. He completed a Master of Arts in leadership studies from the Seminary at Lincoln Christian University, where his final research paper focused on what the Bible teaches on the proper jurisdiction of the family, church and civil government. He has been married to his wife, Sarah, for 19 years. They have four boys.

Tom Hegna, CLU, ChFC, CASL, is an economist, author, and retirement expert. He has been an incredibly popular industry speaker for many years and is considered by many to be THE Retirement Income Expert!.

Tom Hegna, CLU, ChFC, CASL, is an economist, author, and retirement expert. He has been an incredibly popular industry speaker for many years and is considered by many to be THE Retirement Income Expert!.