Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

- What are the hardest, toughest questions I’ve heard people ask?

- Would you like to hear Episode 217?

- Why should I use the company you’re showing me?

- What about this other insurance company’s dividends?

- What’s the story behind the dividend?

- Is the company stable?

- What are the 29 qualifications for a Bank on Yourself® type whole life insurance policy?

- Does the life insurance death benefit cost too much?

- Why can’t I just buy my own bonds?

- How is banking a necessary function in society?

- How will you know which bonds to buy?

- Will you be able to borrow against your bonds?

- Will you have the capacity to buy bulk bonds?

- What about tax?

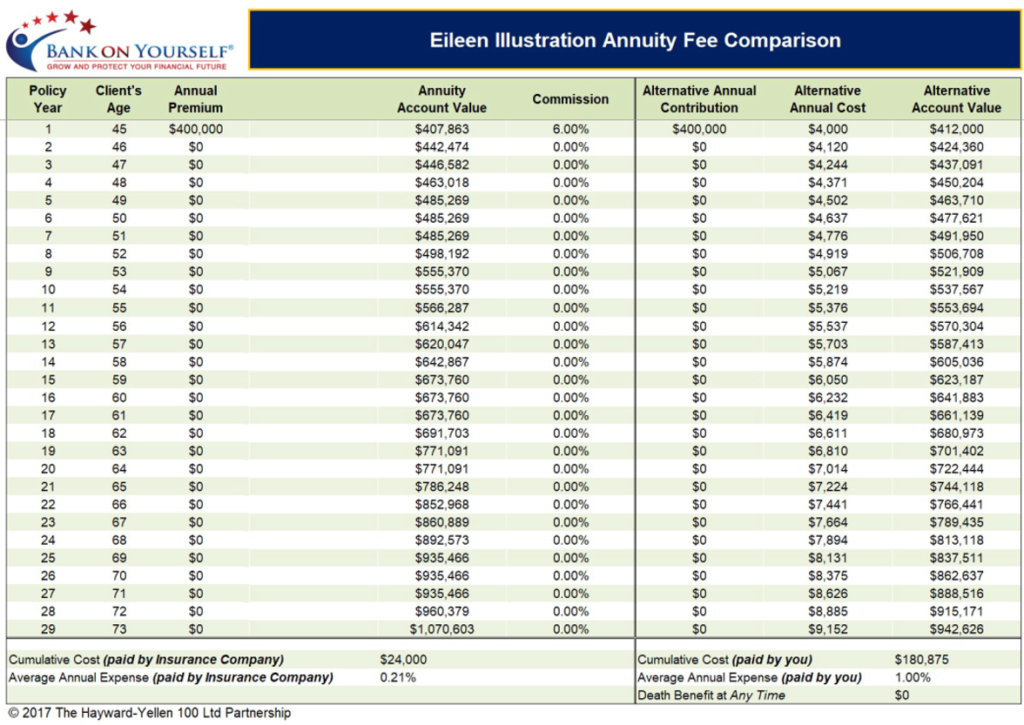

- What about fees?

- What about the true cost of a life insurance death benefit?

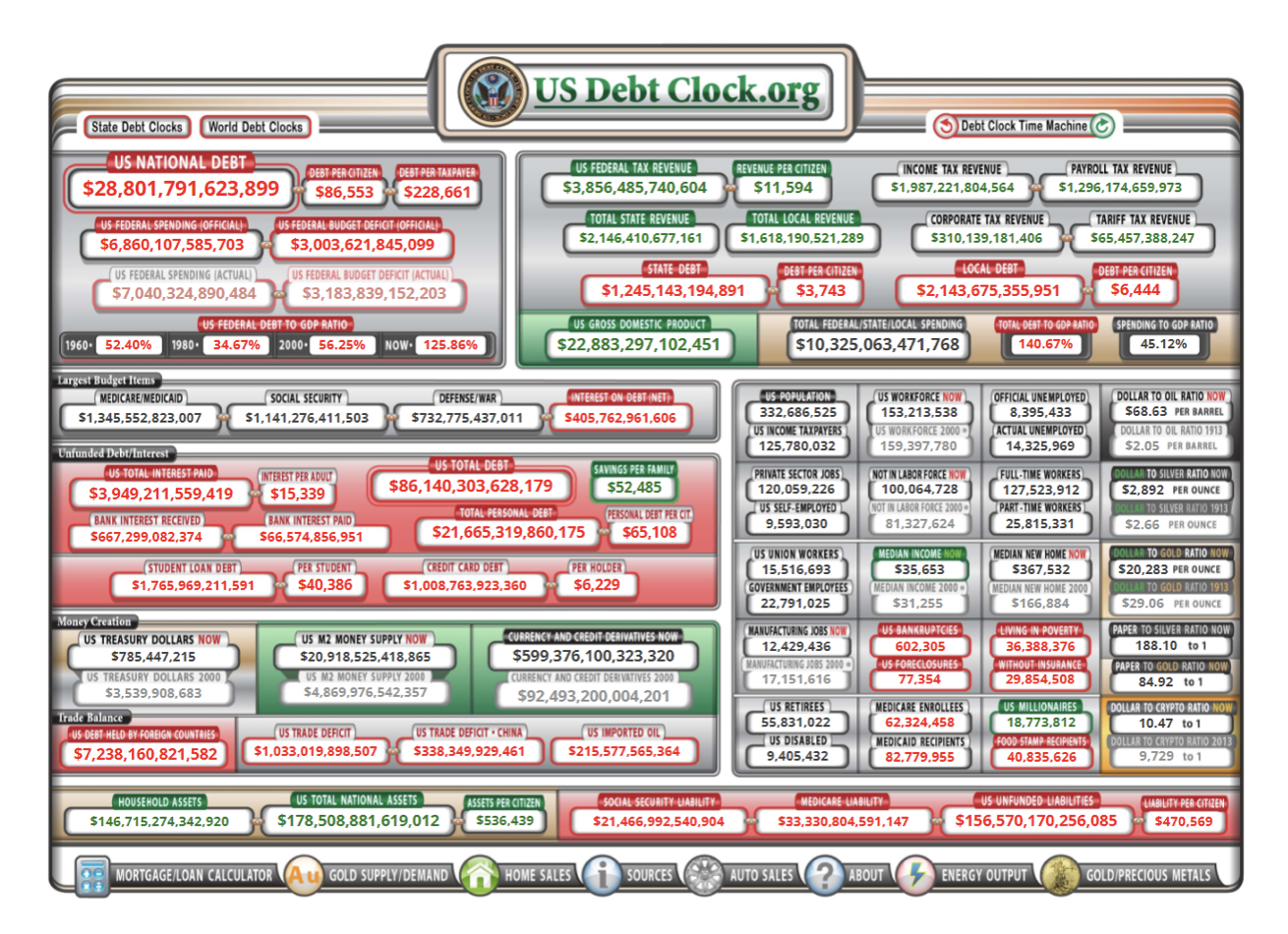

- What happens to policy values if the U.S. dollar becomes less valuable?

- What about the scarcity of a resource?

- What about dollar valued assets?

- What about interest rates rising?

- What happens to your dividends when interest rates rise?

- What about purchasing paid-up additions (PUAs) with dividends?

- How are PUAs like tiny life insurance policies?

- What about contracts?

- Is dividend paying whole life insurance a contract?

- How does one beat inflation?

- How does one beat devaluation of the dollar?

- What about future value?

- What about insurance as a store of value?

- What about life insurance going off the U.S. dollar (someday)?

- What about change of currency (someday)?

- What about the rate of return?

- What about guaranteed growth?

- What about the death benefit going to your loved ones?

- What about the growth rate?

- What about volatility and unpredictability?

- What about getting close to the average rate of return?

- What about you?

- Who needs to know about this?

- What does this spark in you?

- What are people saying?

- Have these episodes been valuable to you?

- Would you like to write a review?

Jeff Hochwalt, CLU, ChFC, Managing Member of Financial Resource Partners, LLIC, has helped more than 450 clients grow their wealth without the risk or volatility of stocks, real estate, and other traditional investments. Jeff helps his clients take control of their finances and reach their financial goals and dreams without taking unnecessary risks. That is why his clients think of him as their “secret weapon,” helping them build and safeguard their wealth.

Jeff Hochwalt, CLU, ChFC, Managing Member of Financial Resource Partners, LLIC, has helped more than 450 clients grow their wealth without the risk or volatility of stocks, real estate, and other traditional investments. Jeff helps his clients take control of their finances and reach their financial goals and dreams without taking unnecessary risks. That is why his clients think of him as their “secret weapon,” helping them build and safeguard their wealth.  Jack Gerstner lives in Elmhurst, IL with his beautiful wife Lauren and their daughter Mia. They have a baby boy due in November 2021. Jack is an Illinois native and has lived here his entire life. He is a Transportation and Logistics professional and an Officer in the Navy Reserve. When he’s not spending time with his family or working, Jack enjoys running, reading, and learning about finance. Jack started his Bank on Yourself journey in June 2014 with Lake Growth Financial and now has multiple policies on him and his family.

Jack Gerstner lives in Elmhurst, IL with his beautiful wife Lauren and their daughter Mia. They have a baby boy due in November 2021. Jack is an Illinois native and has lived here his entire life. He is a Transportation and Logistics professional and an Officer in the Navy Reserve. When he’s not spending time with his family or working, Jack enjoys running, reading, and learning about finance. Jack started his Bank on Yourself journey in June 2014 with Lake Growth Financial and now has multiple policies on him and his family.