Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | RSS

In this episode, we ask:

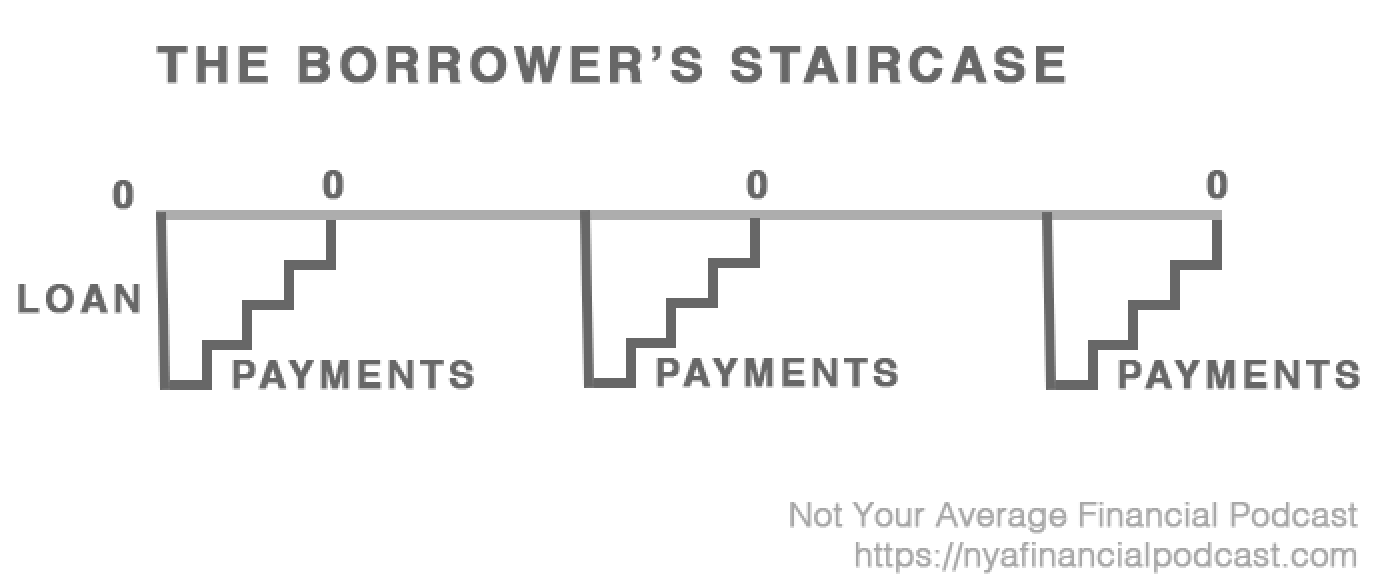

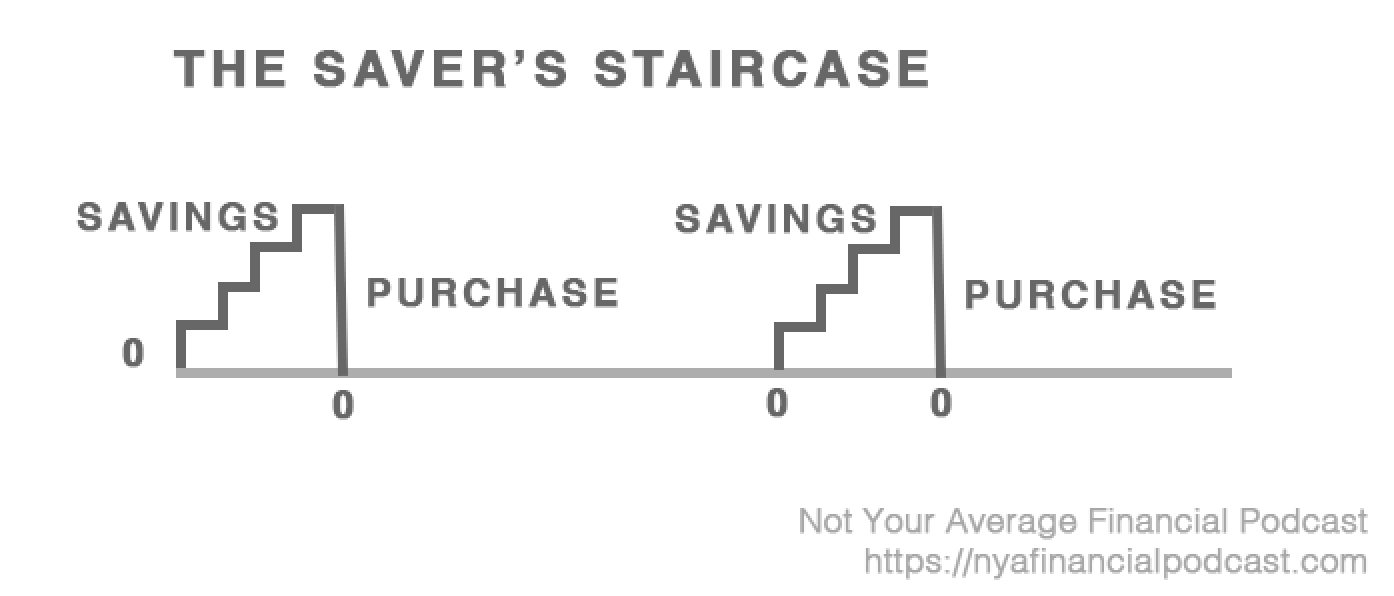

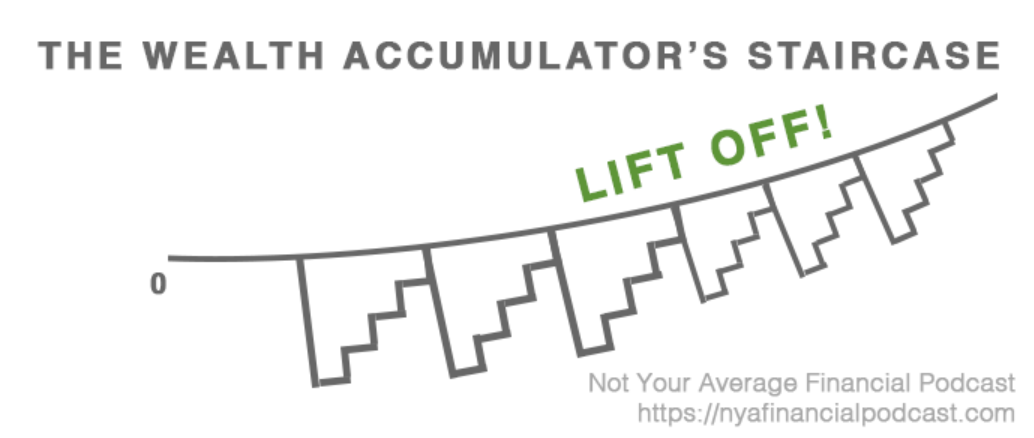

- How might you finance your future without the fees?

- How might you grow and accumulate wealth?

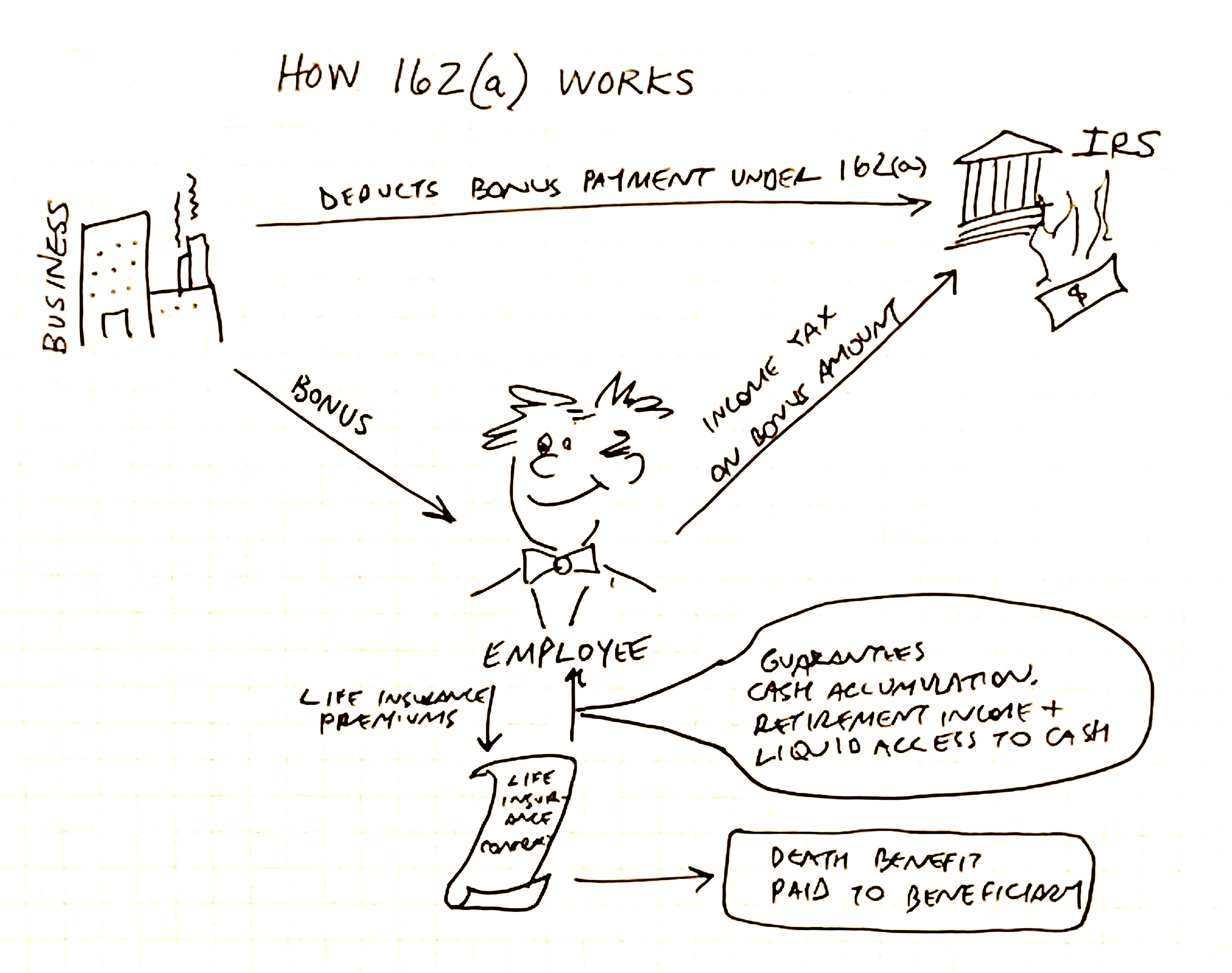

- How about the transformative reality of whole life insurance?

- Who is Evan Greathouse?

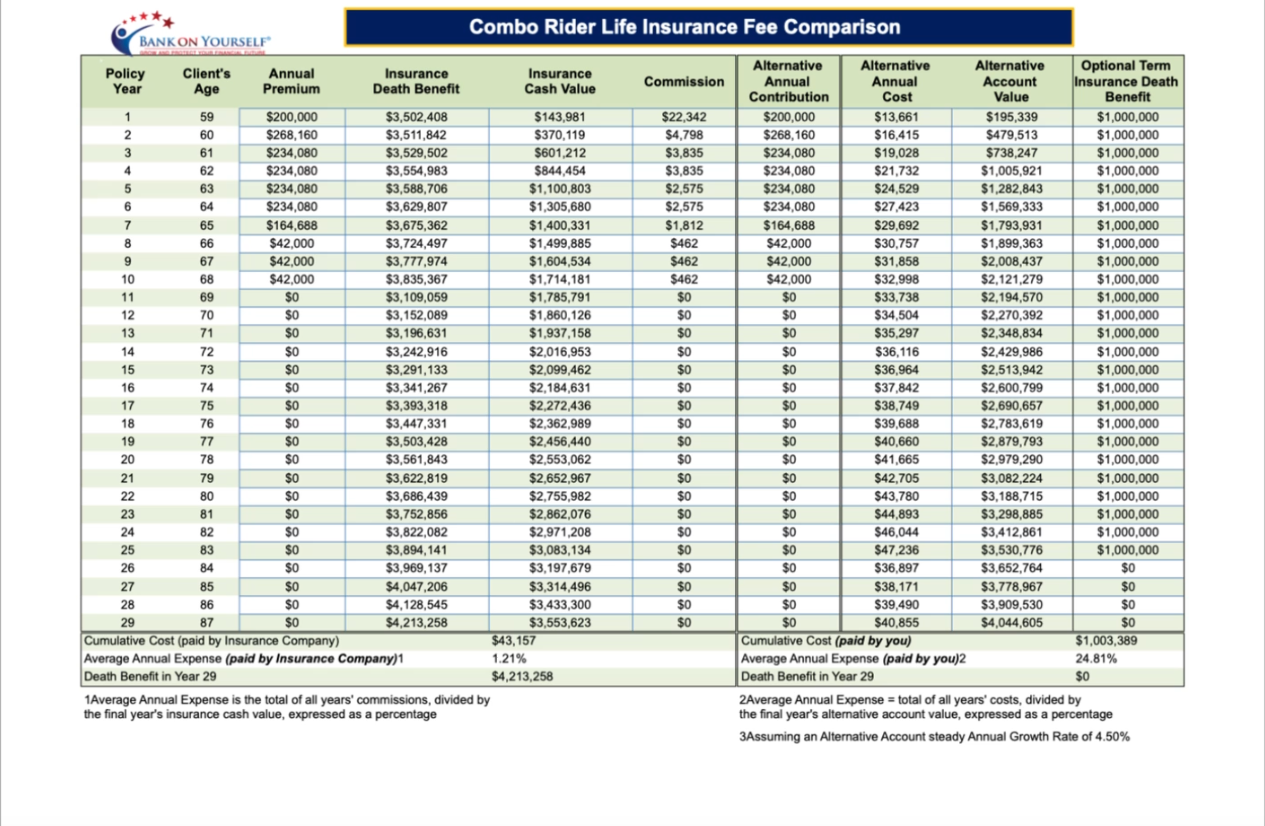

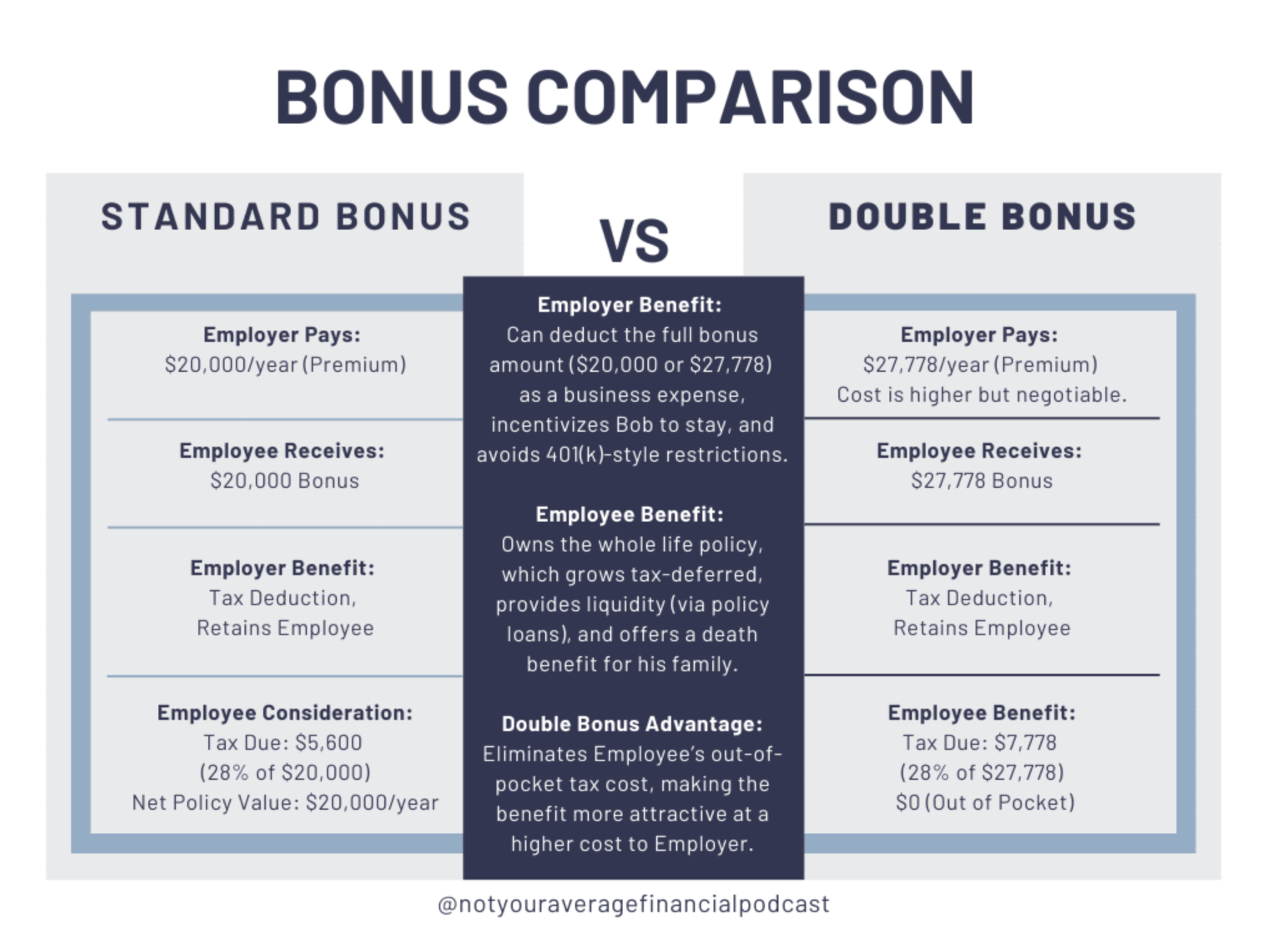

- How about comparing the costs?

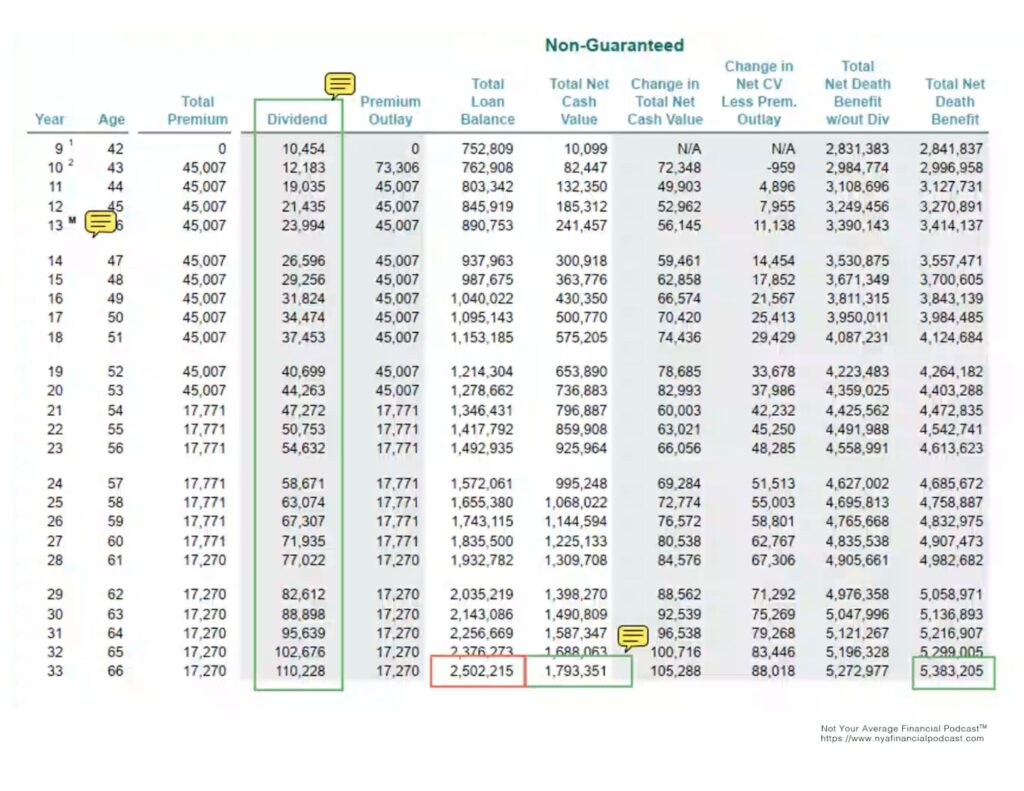

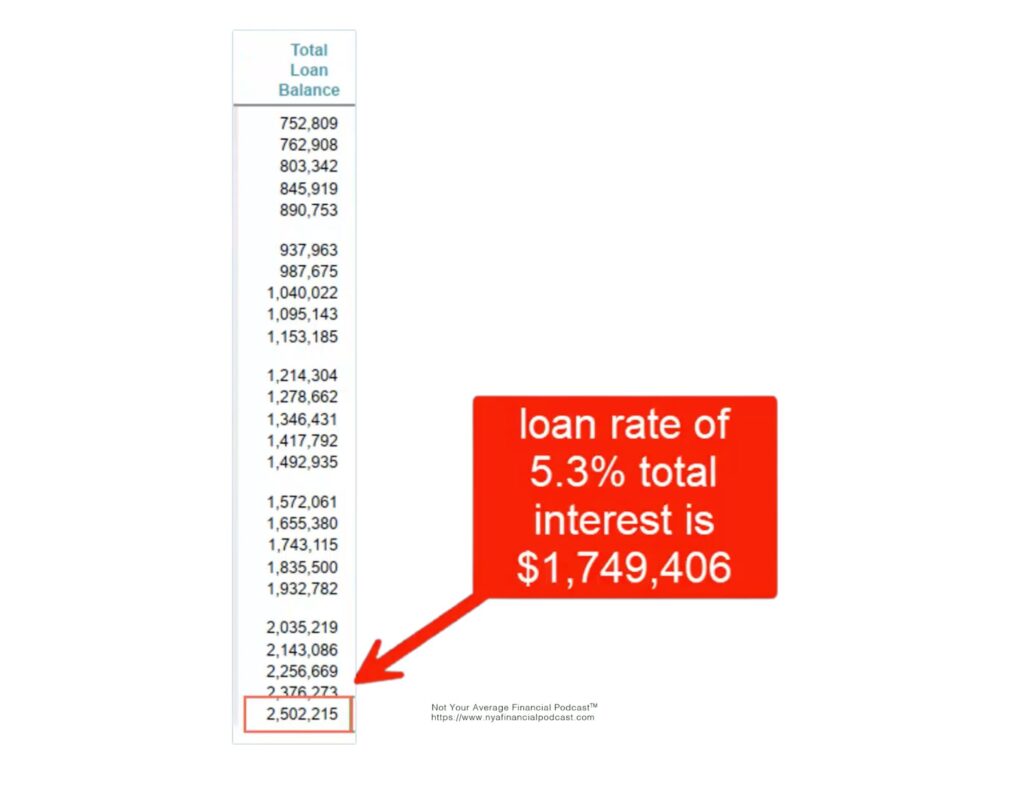

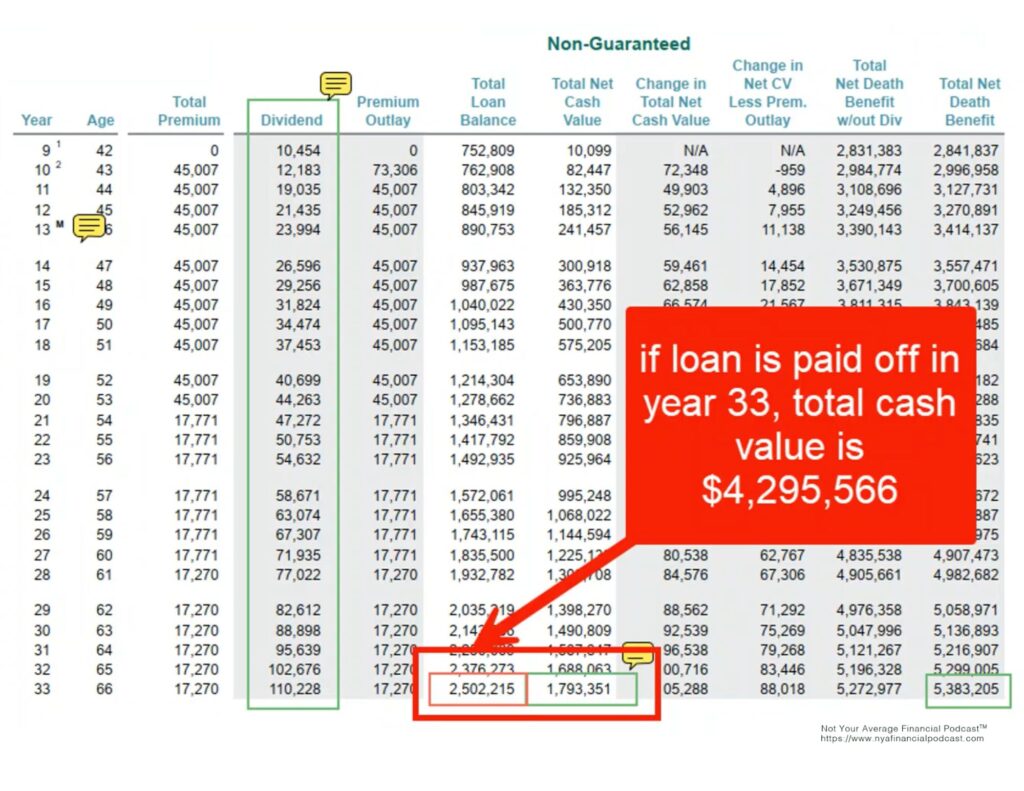

- How about a case study?

- Would you like to hear Episode 143?

- What about irregular or variable premium amounts?

- What about flexibility?

- What happens when premium payments stop?

- What about whole life insurance commission?

- What about investment advisor fees?

- Who makes more?

- What about the performance?

- What about the outcomes?

- What about the liquidity of the cash value life insurance?

- What about the fees and taxes on the investment account?

- What are the limits of a Roth IRA?

- What about capital gains tax?

- What about the cash value?

- What you like to hear Episode 392?

- What about long-term financial planning?

- What are the takeaways?

Evan Greathouse, Bank On Yourself® Professional, brings over 12 years of expertise as a seasoned Real Estate Investor. Holding a Business Management degree from Abilene Christian University, Evan is deeply passionate about his work. His extensive skill set encompasses construction, renovation, sales, marketing, and team building. Evan’s philosophy embraces the mantra of doing things wholeheartedly, driven by a belief that a strong ‘why’ can conquer any ‘how.’ He advocates for embracing failure as a stepping stone to success and cherishes his role as a devoted husband and father to three wonderful children. Evan is located in Nashville, TN. Meet with Evan

Evan Greathouse, Bank On Yourself® Professional, brings over 12 years of expertise as a seasoned Real Estate Investor. Holding a Business Management degree from Abilene Christian University, Evan is deeply passionate about his work. His extensive skill set encompasses construction, renovation, sales, marketing, and team building. Evan’s philosophy embraces the mantra of doing things wholeheartedly, driven by a belief that a strong ‘why’ can conquer any ‘how.’ He advocates for embracing failure as a stepping stone to success and cherishes his role as a devoted husband and father to three wonderful children. Evan is located in Nashville, TN. Meet with Evan

Ben Berry is a financial strategist dedicated to empowering individuals and businesses to achieve financial control and stability. Recognizing the limitations and volatility of traditional investment and retirement planning, Ben and his wife, Erica, embarked on a decade-long exploration of more ethical, rational, and reliable wealth-building methods. This pursuit led him to develop strategies focused on predictable, long-term growth, independent of market fluctuations.

Ben Berry is a financial strategist dedicated to empowering individuals and businesses to achieve financial control and stability. Recognizing the limitations and volatility of traditional investment and retirement planning, Ben and his wife, Erica, embarked on a decade-long exploration of more ethical, rational, and reliable wealth-building methods. This pursuit led him to develop strategies focused on predictable, long-term growth, independent of market fluctuations. Bryan Powers has been an entrepreneur since 2000, owning a recording studio, a live music venue and a couple of restaurant franchises to include Lenny’s Sub Shops and McDonald’s. In 2013, Bryan started Family Home Solutions, a Real Estate Investment Company that expanded into a Local Property Management Company, Realty Brokerage and a Real Estate Acquisitions and Dispositions company. Powers currently shares ownership in over 200 single family rental units and AirBnb properties in 3 states as well as a 356-bed student housing apartment syndication. In 2018, Powers co-created the Angler Aid Brand, a fishing first aid and safety company that is now widely distributed online and through Bass Pro Shops.

Bryan Powers has been an entrepreneur since 2000, owning a recording studio, a live music venue and a couple of restaurant franchises to include Lenny’s Sub Shops and McDonald’s. In 2013, Bryan started Family Home Solutions, a Real Estate Investment Company that expanded into a Local Property Management Company, Realty Brokerage and a Real Estate Acquisitions and Dispositions company. Powers currently shares ownership in over 200 single family rental units and AirBnb properties in 3 states as well as a 356-bed student housing apartment syndication. In 2018, Powers co-created the Angler Aid Brand, a fishing first aid and safety company that is now widely distributed online and through Bass Pro Shops.

Jon Thiele is a W-2 employee, who is passionate about the company he works for, not just for their mission, but for the opportunities that the company has allowed for his career to expand to include fields outside of what he went to school for (which was Architecture). Although he is an Architect, licensed in California and Florida where he and his wife and two kids currently live, he has spent the last couple of years in the Financial Planning & Analysis side of business and has most recently taken on the role of Chief of Staff to one of the Finance VPs. Jon met Mark just before the COVID pandemic began in 2020, and started his journey with Bank on Yourself®. He

Jon Thiele is a W-2 employee, who is passionate about the company he works for, not just for their mission, but for the opportunities that the company has allowed for his career to expand to include fields outside of what he went to school for (which was Architecture). Although he is an Architect, licensed in California and Florida where he and his wife and two kids currently live, he has spent the last couple of years in the Financial Planning & Analysis side of business and has most recently taken on the role of Chief of Staff to one of the Finance VPs. Jon met Mark just before the COVID pandemic began in 2020, and started his journey with Bank on Yourself®. He